Ai hưởng lợi trong Trump-GOP tax cut

Page 1 of 1 • Share

Ai hưởng lợi trong Trump-GOP tax cut

Ai hưởng lợi trong Trump-GOP tax cut

Republicans spent $1.9 trillion on tax cuts that primarily benefited the wealthy and corporations and in return will get a very meager 0.7 percent in additional economic growth over the next decade.

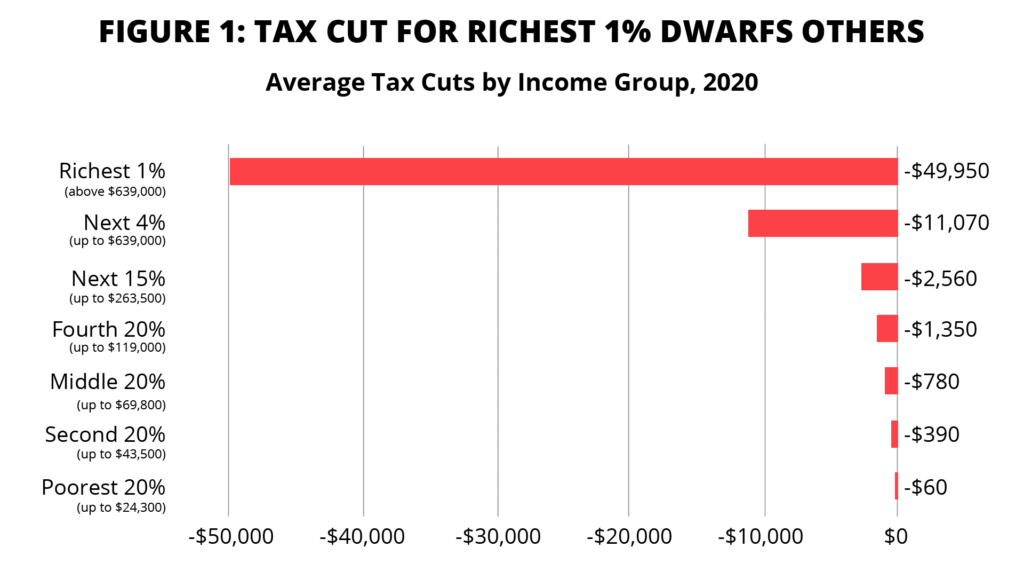

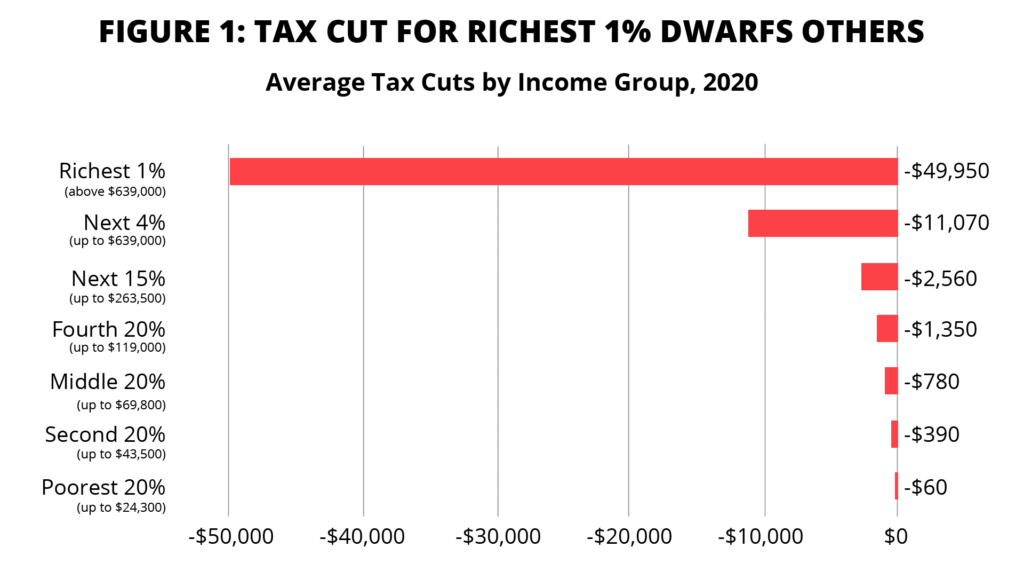

The richest 1% of taxpayers will get an average tax cut of $50,000 in 2020 from the Trump-GOP tax cuts. That’s over 75 times more than the tax cut for the bottom 80% of taxpayers, which will average $645. These figures are comparable to estimates from the Tax Policy Center for 2018, which found the average tax cut for the richest 1% to be $51,000 and the average tax cut for the bottom 80% to be about $800.

Now, let's look at the effect of tariffs that Trump imposed on Chinese goods:

The ever-escalating tariffs on Chinese goods are producing increased costs for American consumers. “On an annual basis, when adding the tariffs in effect and the tariffs set to go into effect by the end of 2019, the costs of the tariffs to consumers will be $259.2 billion. That is, the tariffs will cost the average household $2,031 per year, and will be recurring so long as the tariffs stay in effect,” according to a new National Foundation for American Policy (NFAP) study.

The richest 1% of taxpayers will get an average tax cut of $50,000 in 2020 from the Trump-GOP tax cuts. That’s over 75 times more than the tax cut for the bottom 80% of taxpayers, which will average $645. These figures are comparable to estimates from the Tax Policy Center for 2018, which found the average tax cut for the richest 1% to be $51,000 and the average tax cut for the bottom 80% to be about $800.

Now, let's look at the effect of tariffs that Trump imposed on Chinese goods:

The ever-escalating tariffs on Chinese goods are producing increased costs for American consumers. “On an annual basis, when adding the tariffs in effect and the tariffs set to go into effect by the end of 2019, the costs of the tariffs to consumers will be $259.2 billion. That is, the tariffs will cost the average household $2,031 per year, and will be recurring so long as the tariffs stay in effect,” according to a new National Foundation for American Policy (NFAP) study.

Tax cut for the poor- Guest

JmEqkYXfPU

JmEqkYXfPU

Under Biden, Democrats are poised to raise taxes on business and the rich

https://economictimes.indiatimes.com/news/international/world-news/under-biden-democrats-are-poised-to-raise-taxes-on-business-and-the-rich/articleshow/81737737.cms

Democrats have spent the last several years clamoring to raise taxes on corporations and the rich, seeing that as a necessary antidote to widening economic inequality and a rebuke of former President Donald Trump’s signature tax cuts.

Now, under President Joe Biden, they have a shot at ushering in the largest federal tax increase since 1942. It could help pay for a host of spending programs that liberal economists predict would bolster the economy’s performance and repair a tax code that Democrats say encourages wealthy people to hoard assets and big companies to ship jobs and book profits overseas.

The question is whether congressional Democrats and the White House can agree on how sharply taxes should rise and who, exactly, should pay the bill. They widely share the goal of reversing many of Trump’s tax cuts from 2017 and of making the wealthy and big businesses pay more. But they do not yet agree on the details — and because Republicans are unlikely to support their efforts, they have no room for error in a closely divided Senate.

...

Read more at:

https://economictimes.indiatimes.com/news/international/world-news/under-biden-democrats-are-poised-to-raise-taxes-on-business-and-the-rich/articleshow/81737737.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

https://economictimes.indiatimes.com/news/international/world-news/under-biden-democrats-are-poised-to-raise-taxes-on-business-and-the-rich/articleshow/81737737.cms

Democrats have spent the last several years clamoring to raise taxes on corporations and the rich, seeing that as a necessary antidote to widening economic inequality and a rebuke of former President Donald Trump’s signature tax cuts.

Now, under President Joe Biden, they have a shot at ushering in the largest federal tax increase since 1942. It could help pay for a host of spending programs that liberal economists predict would bolster the economy’s performance and repair a tax code that Democrats say encourages wealthy people to hoard assets and big companies to ship jobs and book profits overseas.

The question is whether congressional Democrats and the White House can agree on how sharply taxes should rise and who, exactly, should pay the bill. They widely share the goal of reversing many of Trump’s tax cuts from 2017 and of making the wealthy and big businesses pay more. But they do not yet agree on the details — and because Republicans are unlikely to support their efforts, they have no room for error in a closely divided Senate.

...

Read more at:

https://economictimes.indiatimes.com/news/international/world-news/under-biden-democrats-are-poised-to-raise-taxes-on-business-and-the-rich/articleshow/81737737.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Tax the rich- Guest

JmEqkYXfPU

JmEqkYXfPU

Who Will Be The Biggest Losers From Biden’s Tax Hikes?

https://www.forbes.com/sites/sarahhansen/2021/03/30/heres-who-could-lose-big-due-to-bidens-tax-hikes/?sh=6e8ff6ab39ac

...

Biden is a proponent of raising the corporate tax rate from 21% to 28%—a major hike, but still 7 percentage points less than the 35% corporate tax rate under Presidents Obama, Bush and Clinton. He wants to impose a 15% minimum tax on big companies too, meaning that even if a company takes a lot of credits and deductions it would still have to pay taxes of at least 15% on its earnings. That’s intended to prevent the country’s largest companies like Amazon from using those deductions and credits to skirt their fair share of taxes.

Companies with large portions of income from overseas or those who pay effective tax rates below 21%—e.g. data storage company Seagate Technology, casino player Las Vegas Sands, semiconductor maker Broadcom, and money transfer giant Western Union—could be especially vulnerable to tax changes that would target that income, according to Goldman Sachs. Goldman pegs Las Vegas Sands’ foreign income exposure at 83%.

According to a recent analysis by Tax Notes chief economist Martin Sullivan, 33 of the 100 largest U.S. companies might be on the hook for Biden’s 15% minimum tax, including giants like AT&T, Nvidia, Adobe, JPMorgan Chase, Intel and Target. Altogether, those 33 companies would owe an extra $20 billion each year if that new tax were enacted by itself, though Sullivan notes that the ultimate effect of the minimum tax will probably be smaller than that since it's likely to come alongside other corporate tax hikes.

https://www.forbes.com/sites/sarahhansen/2021/03/30/heres-who-could-lose-big-due-to-bidens-tax-hikes/?sh=6e8ff6ab39ac

...

Biden is a proponent of raising the corporate tax rate from 21% to 28%—a major hike, but still 7 percentage points less than the 35% corporate tax rate under Presidents Obama, Bush and Clinton. He wants to impose a 15% minimum tax on big companies too, meaning that even if a company takes a lot of credits and deductions it would still have to pay taxes of at least 15% on its earnings. That’s intended to prevent the country’s largest companies like Amazon from using those deductions and credits to skirt their fair share of taxes.

Companies with large portions of income from overseas or those who pay effective tax rates below 21%—e.g. data storage company Seagate Technology, casino player Las Vegas Sands, semiconductor maker Broadcom, and money transfer giant Western Union—could be especially vulnerable to tax changes that would target that income, according to Goldman Sachs. Goldman pegs Las Vegas Sands’ foreign income exposure at 83%.

According to a recent analysis by Tax Notes chief economist Martin Sullivan, 33 of the 100 largest U.S. companies might be on the hook for Biden’s 15% minimum tax, including giants like AT&T, Nvidia, Adobe, JPMorgan Chase, Intel and Target. Altogether, those 33 companies would owe an extra $20 billion each year if that new tax were enacted by itself, though Sullivan notes that the ultimate effect of the minimum tax will probably be smaller than that since it's likely to come alongside other corporate tax hikes.

Tax hike- Guest

Similar topics

Similar topics» Tòa án Manhatta NY có thể sẽ truy tố Trump trong vài ngày tới

» Hướng dẫn cá độ bóng đá bằng thẻ điện thoại chủ trong 3 phút

» Hướng dẫn kiếm tiền trong khoảng cá độ bóng đá online

» Lần đầu tiên trong đời Mr Trump quíu

» Facebook & Instagram xóa video phỏng vấn Trump do Lara Trump thực hiện

» Hướng dẫn cá độ bóng đá bằng thẻ điện thoại chủ trong 3 phút

» Hướng dẫn kiếm tiền trong khoảng cá độ bóng đá online

» Lần đầu tiên trong đời Mr Trump quíu

» Facebook & Instagram xóa video phỏng vấn Trump do Lara Trump thực hiện

Page 1 of 1

Permissions in this forum:

You can reply to topics in this forum

Home

Home