What do you do?

Page 1 of 2 • Share

Page 1 of 2 • 1, 2

Re: What do you do?

Re: What do you do?

8DonCo wrote:kệ nó , cũng đâu có dip bằng hồi mới có Covid

Contribution cua bac8 bao nhieu percent vay? I maxed out mine va thay no’ -do? lem lam minh buon qua troi

BeiBei

Re: What do you do?

Re: What do you do?

LoveStory08 wrote:Leave it alone... What does down must comes up, sis.

I wonder if there’s a fee for changing the contribution. ??

BeiBei

Re: What do you do?

Re: What do you do?

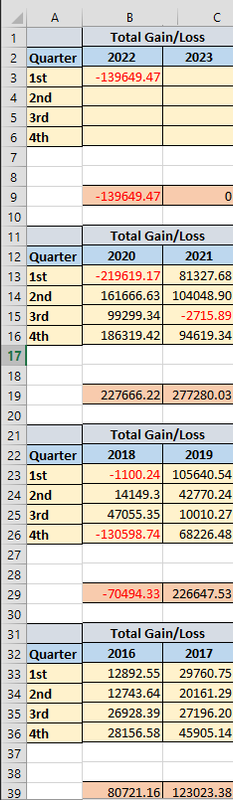

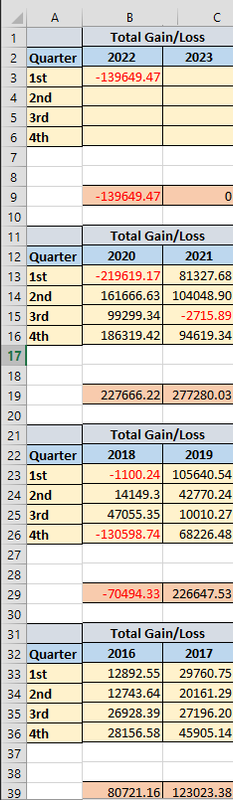

Nothing, last week I lost $180k in 401k, maybe today will drop another $70K. Try to login every night at 9pm to check the loss so you can control your mind. When you get used to it, you no longer get panic. I also lost $150K with individual stock. So total both account around $500k but loss the gain though.

After 15 mins posting, I gain back 100k

After 15 mins posting, I gain back 100k

After 15 mins posting, I gain back 100k

After 15 mins posting, I gain back 100k

BrokeAssMillionaire

Re: What do you do?

Re: What do you do?

ga10 wrote:Buy more if you can affort it!

Max without penalty is $19,500. Bo them co’ bi phat ko sis Ga?

BeiBei

Re: What do you do?

Re: What do you do?

BrokeAssMillionaire wrote:Nothing, last week I lost $180k in 401k, maybe today will drop another $70K. Try to login every night at 9pm to check the loss so you can control your mind. When you get used to it, you no longer get panic. I also lost $150K with individual stock. So total both account around $500k but loss the gain though.

After 15 mins posting, I gain back 100k

Thay may’ con so^’ bright red nhin thay ghe wa’.

BeiBei

Re: What do you do?

Re: What do you do?

Keep contribute as normal. Don't change anything. My company refunded the extra at the end of year with tax deduction. Let say $100 extra, they would refund $70, $30 for tax  If the company doesn't return the extra, you may pay the penalty but sure the company would do a refund extra so they can get way headache with paperwork. That's the simple route for both you and the company.

If the company doesn't return the extra, you may pay the penalty but sure the company would do a refund extra so they can get way headache with paperwork. That's the simple route for both you and the company.

Nope, you won't lose anything. Even it drops 50%, it will come back in few years. You only worry when you plan to withdraw. If you plan to withdraw some at 60, then at 57 you want to move 30% the fund to low risk in case stock crashes.

If the company doesn't return the extra, you may pay the penalty but sure the company would do a refund extra so they can get way headache with paperwork. That's the simple route for both you and the company.

If the company doesn't return the extra, you may pay the penalty but sure the company would do a refund extra so they can get way headache with paperwork. That's the simple route for both you and the company.Nope, you won't lose anything. Even it drops 50%, it will come back in few years. You only worry when you plan to withdraw. If you plan to withdraw some at 60, then at 57 you want to move 30% the fund to low risk in case stock crashes.

BrokeAssMillionaire

Re: What do you do?

Re: What do you do?

BrokeAssMillionaire wrote:Keep contribute as normal. Don't change anything. My company refunded the extra at the end of year with tax deduction. Let say $100 extra, they would refund $70, $30 for taxIf the company doesn't return the extra, you may pay the penalty but sure the company would do a refund extra so they can get way headache with paperwork. That's the simple route for both you and the company.

Nope, you won't lose anything. Even it drops 50%, it will come back in few years. You only worry when you plan to withdraw. If you plan to withdraw some at 60, then at 57 you want to move 30% the fund to low risk in case stock crashes.

Every single time I check, the number was always so pretty. Just yesterday and today lam minh het hon.

BeiBei

Re: What do you do?

Re: What do you do?

Why not have 1 plan only? 5500 in 401k con lai thi bo vo IRA het

I am in high risk with Large, Mid, and Small Caps. Mid has 60% and never touch for 20 years.

with Large, Mid, and Small Caps. Mid has 60% and never touch for 20 years.

I am in high risk

with Large, Mid, and Small Caps. Mid has 60% and never touch for 20 years.

with Large, Mid, and Small Caps. Mid has 60% and never touch for 20 years.

BrokeAssMillionaire

Re: What do you do?

Re: What do you do?

I know, bizarre right? 401k dropped wa chung lam tinh than minh loan len, nen noi vay thoi.

401k dropped wa chung lam tinh than minh loan len, nen noi vay thoi.

Nguoi ta tien cang nhieu thi cang so*. Minh thi nguoc lai, tien ko bang ai het ma hot wang? wai.

Btw: Have you figured out a way from paying capital gain taxes if you’re to sell your rental home, without moving back?

Nguoi ta tien cang nhieu thi cang so*. Minh thi nguoc lai, tien ko bang ai het ma hot wang? wai.

Btw: Have you figured out a way from paying capital gain taxes if you’re to sell your rental home, without moving back?

BeiBei

Re: What do you do?

Re: What do you do?

There are many conditions that you can get away if you follow the law

1. You must live in the rental home for 2 years to get away from capital gain tax. This is easy, I currently live in 2 houses as long as bills on my name

2. You can't do step 1 if you have more than 2 houses. The third house MUST be rental unless the 3rd house is 50 miles away to be as vacation home. Actually, you can if you move into rental home for 2 years but it would be a hassle so I sold 1 last year to stick with 2 only.

3. The problem is the capitol gain is over 350K so I don't want to pay 70k tax on it. If it's 5k capitol gain, i am careless about it, can sell anytime.

4. I like to keep the rental house as primary for 5 more years to get some benefit if I plan to buy a new house where I can transfer a portion of cheap property tax to a new house where it costs more.

1. You must live in the rental home for 2 years to get away from capital gain tax. This is easy, I currently live in 2 houses as long as bills on my name

2. You can't do step 1 if you have more than 2 houses. The third house MUST be rental unless the 3rd house is 50 miles away to be as vacation home. Actually, you can if you move into rental home for 2 years but it would be a hassle so I sold 1 last year to stick with 2 only.

3. The problem is the capitol gain is over 350K so I don't want to pay 70k tax on it. If it's 5k capitol gain, i am careless about it, can sell anytime.

4. I like to keep the rental house as primary for 5 more years to get some benefit if I plan to buy a new house where I can transfer a portion of cheap property tax to a new house where it costs more.

BrokeAssMillionaire

Re: What do you do?

Re: What do you do?

What happens if after you move back, fixer up the house, about to sell it to realize that your supposedly market value million dollar home now is worth under 200k?  What will you do? Continue living there until it goes up again?

What will you do? Continue living there until it goes up again?

BeiBei

Re: What do you do?

Re: What do you do?

Graduate from college at 22. Work for 10-20 years and retire. Now, that’s the plan and wish we all hope would happen.

BeiBei

Re: What do you do?

Re: What do you do?

Your assumption is too high. I paid only 105k when housing was crashed

If it drops, I can keep for family to stay. No big deal

Graduate at 22? wow super. I didn't until 28 only 12 units/semester. Was enjoy eating, bida, hang around. etc

only 12 units/semester. Was enjoy eating, bida, hang around. etc

If it drops, I can keep for family to stay. No big deal

Graduate at 22? wow super. I didn't until 28

only 12 units/semester. Was enjoy eating, bida, hang around. etc

only 12 units/semester. Was enjoy eating, bida, hang around. etc

BrokeAssMillionaire

Re: What do you do?

Re: What do you do?

BrokeAssMillionaire wrote:Your assumption is too high. I paid only 105k when housing was crashed

If it drops, I can keep for family to stay. No big deal

Graduate at 22? wow super. I didn't until 28only 12 units/semester. Was enjoy eating, bida, hang around. etc

You can’t find even a 40 year old house

that price anymore, unless you move to Mississippi.

You’re lucky you’re in it before the prices started to go up.

Ko invest, minh lam ca doi ko biet co’ thay over a mil chua. I’m speaking for you bro.

BeiBei

Page 1 of 2 • 1, 2

Page 1 of 2

Permissions in this forum:

You cannot reply to topics in this forum

Home

Home