ăn bạo

Page 2 of 2 • Share

Page 2 of 2 •  1, 2

1, 2

Re: ăn bạo

Re: ăn bạo

Assume: $20,500 for 2022 = Total Contribution + 5% <--- so do your math

Traditional 401K: pretax <---Tax when withdraw

Roth 401K: after tax <-------No Tax withdraw

1. Check your tax bracket to find out which one has more benefit

---Example: your tax bracket is 24% over 86k, under 86K at 22%, and under 40k at 12% for 100K salary

--------------If you make 120K minus 20500, your tax still at 24% so Roth is better since no tax deduction at all

--------------If you make 100K minus 20500, your tax still at 22% so Roth may be better since not much tax deduction

--------------If you make 80K minus 20500, your tax still at 22% so either one is fine

--------------If you make 70K minus 20500, your tax may get down to 12% with tradition where you get down under 40k

2. All the cases in #1 still depend on how much that you withdraw at 60 year old.

---If you take out 20k/year, then tax will be 12%

---For 86k/year, you will get slap at 24%

---If take out all, don't cry with the tax.

3. If you think you can get tax deduce, Tradition 401k is the best way since it can reduce your tax bracket.

4. However, not all the cases above are working for you.

---Assume standard deduction is $12500, then all your add up deduction is 8k, then Roth 401k has more benefit.

---If you can whoop up to 15k-20k deduction, Tradition 401k is the best because you get more tax return.

5. Still BS in some cases. I can't remember exactly since tax keeps change every year. If you make over $140k or $160k , you can't get tax deduction at all with rental property.

6. I think it's good idea to have 60% traditional and 40% roth or 70/30

---Assume you start take out a portion each at starting at 60, you wan to do traditional first then keep roth to grow until you get all traditional out then take out all Roth at any time since there is no tax.

Sorry, I talk too much. I don't care much about money except getting low tax as possible.

Sorry, I talk too much. I don't care much about money except getting low tax as possible.

The last time I checked was Feb 2022. I am still crying how to get low tax when I start taking out at 60

Traditional 401K: pretax <---Tax when withdraw

Roth 401K: after tax <-------No Tax withdraw

1. Check your tax bracket to find out which one has more benefit

---Example: your tax bracket is 24% over 86k, under 86K at 22%, and under 40k at 12% for 100K salary

--------------If you make 120K minus 20500, your tax still at 24% so Roth is better since no tax deduction at all

--------------If you make 100K minus 20500, your tax still at 22% so Roth may be better since not much tax deduction

--------------If you make 80K minus 20500, your tax still at 22% so either one is fine

--------------If you make 70K minus 20500, your tax may get down to 12% with tradition where you get down under 40k

2. All the cases in #1 still depend on how much that you withdraw at 60 year old.

---If you take out 20k/year, then tax will be 12%

---For 86k/year, you will get slap at 24%

---If take out all, don't cry with the tax.

3. If you think you can get tax deduce, Tradition 401k is the best way since it can reduce your tax bracket.

4. However, not all the cases above are working for you.

---Assume standard deduction is $12500, then all your add up deduction is 8k, then Roth 401k has more benefit.

---If you can whoop up to 15k-20k deduction, Tradition 401k is the best because you get more tax return.

5. Still BS in some cases. I can't remember exactly since tax keeps change every year. If you make over $140k or $160k , you can't get tax deduction at all with rental property.

6. I think it's good idea to have 60% traditional and 40% roth or 70/30

---Assume you start take out a portion each at starting at 60, you wan to do traditional first then keep roth to grow until you get all traditional out then take out all Roth at any time since there is no tax.

Sorry, I talk too much. I don't care much about money except getting low tax as possible.

Sorry, I talk too much. I don't care much about money except getting low tax as possible. The last time I checked was Feb 2022. I am still crying how to get low tax when I start taking out at 60

BrokeAssMillionaire

Re: ăn bạo

Re: ăn bạo

bro BAM - Đep để cho OX làm hết, đưa cái login cho ổng gùi ổng muốn làm gì làm

nhatrangdep

Re: ăn bạo

Re: ăn bạo

If he can manipulate all the tax scenario, you would be happy at the end.  The main goal is to beat the tax bracket.

The main goal is to beat the tax bracket.

The main goal is to beat the tax bracket.

The main goal is to beat the tax bracket.

BrokeAssMillionaire

Re: ăn bạo

Re: ăn bạo

ga10 wrote:Sẳn đây cho Gà hỏi ké có cách nào làm cho mặt mình đầy đặn hơn without gaining a lot of weight 0?

Gà bị sụt mất 10 pounds in the last 6 months and it shows on my face/neck. 2 gò má và 2 temples bị hóp thấy rõ. Shoulder blades cũng thấy xương xẩu nhiều hơn.

Khi lên cân thì bị bụng và mông bự hơn which I don't want. Nhưng khi sụt kí thì sụt ở ngực & my face which are areas that I don't want to lose!

Gà ăn thêm đi, nếu không muốn nhìn hốc hác quá. Sau bữa cơm ăn thêm đồ ngọt như chè, bánh ngọt, hay kem rất mau lấy lại cân.

Cuom

Re: ăn bạo

Re: ăn bạo

Bác BAM, nói tóm lại nếu mình ở lower tax bracket, nên để tiền thêm vào traditional IRA. Nếu mình ở higher tax bracket, nên để thêm tiền vào Roth IRA. Đúng không?

Cuom

Re: ăn bạo

Re: ăn bạo

No, tuỳ theo trường họp của mỏi gia đình

For me, I'm always looking at tax bracket and how much I spend each year to decide how to contribute. I believe you get more tax return with rental property and tradition 401k at 100k salary. I can estimate ahead in a year such as "do I need new TV, car, etc?" I have done this for 20 years to get tax under 15%. Even with rental property, I still look to see how I want to spend to maximize my tax return. For the last 10 years with rental property, I was able to get back 5k-7k each year. I don't know if I am correct but for rental property, the first 6 years would get a lot of tax return so I got rid of the rental at 6th year since there there is no benefit for tax return.

I can estimate ahead in a year such as "do I need new TV, car, etc?" I have done this for 20 years to get tax under 15%. Even with rental property, I still look to see how I want to spend to maximize my tax return. For the last 10 years with rental property, I was able to get back 5k-7k each year. I don't know if I am correct but for rental property, the first 6 years would get a lot of tax return so I got rid of the rental at 6th year since there there is no benefit for tax return.

Let say you want to pay 12% which mean you would have 40K/year. Ask yourself if you can survive on that income.

For example, you make 70k, minus 20k traditional 401k, and minus another 10k deduction, you would end up below 40k so instead of paying 22% tax, you will pay 12% tax. In this case, Tradition is better than Roth.

If you can't get any deduction at all after standard tax deduction, then Roth is more benefit.

But let say 20 years later, there is no gain in Roth, then it's no benefit. So it's a game of 50/50, take a chance.

For me, I'm always looking at tax bracket and how much I spend each year to decide how to contribute. I believe you get more tax return with rental property and tradition 401k at 100k salary.

I can estimate ahead in a year such as "do I need new TV, car, etc?" I have done this for 20 years to get tax under 15%. Even with rental property, I still look to see how I want to spend to maximize my tax return. For the last 10 years with rental property, I was able to get back 5k-7k each year. I don't know if I am correct but for rental property, the first 6 years would get a lot of tax return so I got rid of the rental at 6th year since there there is no benefit for tax return.

I can estimate ahead in a year such as "do I need new TV, car, etc?" I have done this for 20 years to get tax under 15%. Even with rental property, I still look to see how I want to spend to maximize my tax return. For the last 10 years with rental property, I was able to get back 5k-7k each year. I don't know if I am correct but for rental property, the first 6 years would get a lot of tax return so I got rid of the rental at 6th year since there there is no benefit for tax return.Let say you want to pay 12% which mean you would have 40K/year. Ask yourself if you can survive on that income.

For example, you make 70k, minus 20k traditional 401k, and minus another 10k deduction, you would end up below 40k so instead of paying 22% tax, you will pay 12% tax. In this case, Tradition is better than Roth.

If you can't get any deduction at all after standard tax deduction, then Roth is more benefit.

But let say 20 years later, there is no gain in Roth, then it's no benefit. So it's a game of 50/50, take a chance.

BrokeAssMillionaire

Re: ăn bạo

Re: ăn bạo

bac' BAM - nếu bác đổi ý nhận ghệ già thì cho mình hay nha ..chỉ cân 1/4 phần tài sản của bác thui hem cần nhiều

nhatrangdep

Re: ăn bạo

Re: ăn bạo

Khi nảo tui nằm liệt giưòng thì lúc đó tui sẽ lấy em về thay tả đút ăn cho tui. Tất cả tài sản tui sẽ tặng hết

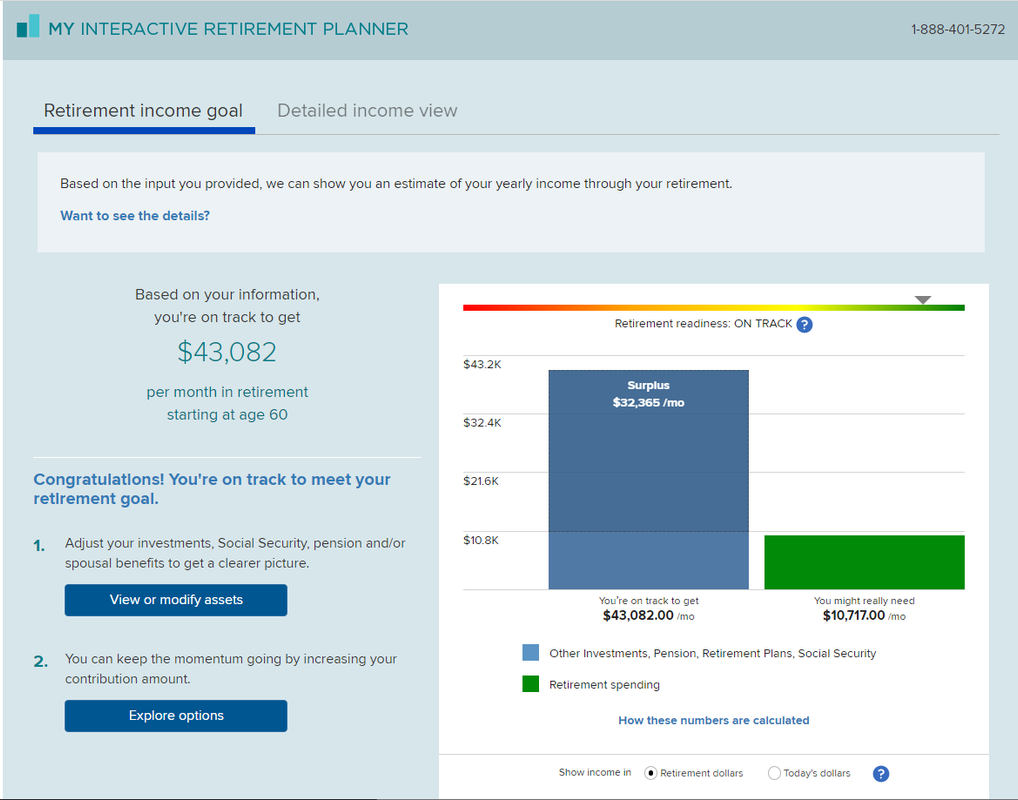

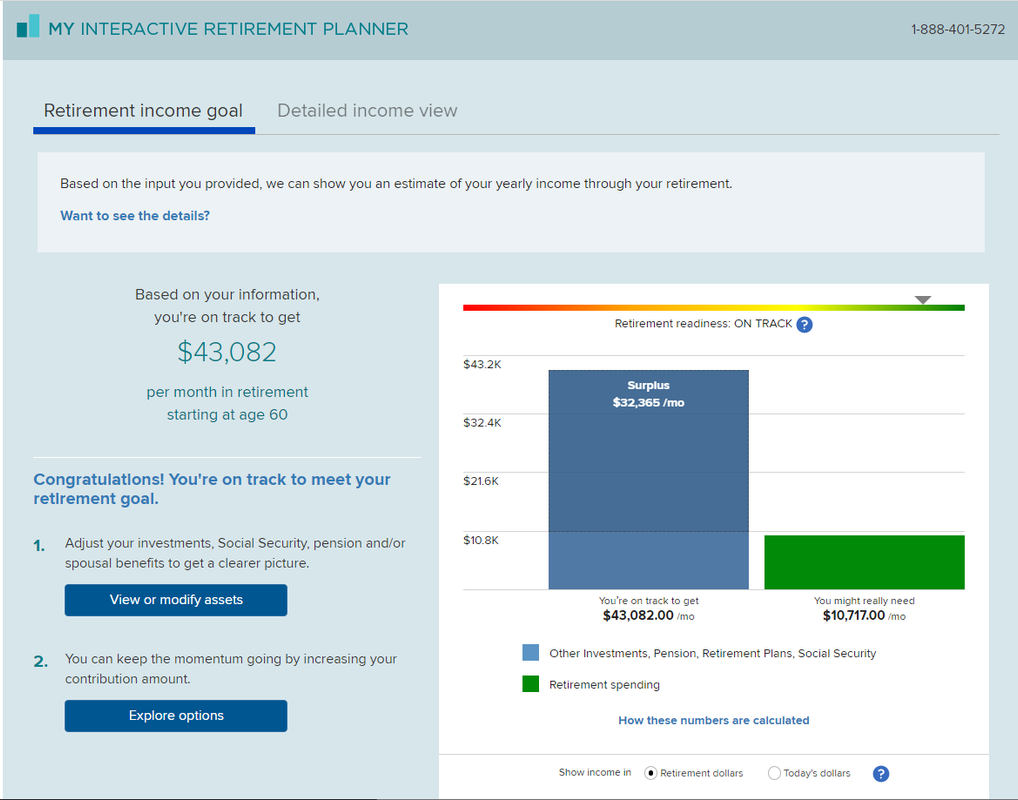

Nhưng tui thấy tiếc nếu lấy ghệ già bởi vì my pension and free healthcare is for life

bởi vì my pension and free healthcare is for life

Ghệ 50, sống tới 60 thì hưởng có 10 năm. 3k/month, là 360k for 10 years

Ghệ 40, sống tới 60 thì hưởng 20 năm. 3k/month, là 720k

Ghệ 30, sống tới 60 thì hưởng 30 năm. 3k/month, là 1 mil

Tui nghĩ nên lấy ghệ 30, cho nó hưởng 30-50 năm, như vậy tui mới thấy đáng đồng tiền tui đã bỏ sức mòn mỏi xây dựng

Nhưng tui thấy tiếc nếu lấy ghệ già

bởi vì my pension and free healthcare is for life

bởi vì my pension and free healthcare is for lifeGhệ 50, sống tới 60 thì hưởng có 10 năm. 3k/month, là 360k for 10 years

Ghệ 40, sống tới 60 thì hưởng 20 năm. 3k/month, là 720k

Ghệ 30, sống tới 60 thì hưởng 30 năm. 3k/month, là 1 mil

Tui nghĩ nên lấy ghệ 30, cho nó hưởng 30-50 năm, như vậy tui mới thấy đáng đồng tiền tui đã bỏ sức mòn mỏi xây dựng

BrokeAssMillionaire

Re: ăn bạo

Re: ăn bạo

BrokeAssMillionaire wrote:No, tuỳ theo trường họp của mỏi gia đình

Let say you want to pay 12% which mean you would have 40K/year. Ask yourself if you can survive on that income.

For example, you make 70k, minus 20k traditional 401k, and minus another 10k deduction, you would end up below 40k so instead of paying 22% tax, you will pay 12% tax. In this case, Tradition is better than Roth.

If you can't get any deduction at all after standard tax deduction, then Roth is more benefit.

But let say 20 years later, there is no gain in Roth, then it's no benefit. So it's a game of 50/50, take a chance.

I like this example. Thanks BAM.

Cuom

Re: ăn bạo

Re: ăn bạo

ai cũng muốn bỏ vô 401k max vừa được giảm thuế vừa để dành tiết kiệm sau khi về hưu, nhưng xăng cao giá cả cái gì cũng lên vùn vụt, họ nghĩ hiện tại chưa biết sao hơi đâu mà lo xa, tiền cần dùng cho hàng tháng lãnh ra bay cái vèo nên đa số họ bỏ vào 401k chỉ vài ngàn trong một năm thôi, có khi không thể bỏ vào vì cuộc sống phải tính từng đồng, người Mỹ khôn hơn vì có bỏ vào 401k thì mới hưởng mấy % của Employer’s matching, kiến tha lâu ngày sẽ đầy tổ, tiết kiệm lâu ngày cũng có funds để xài

Tui thấy mấy em chân dài khoái người giàu nhưng suy cho cùng, người giàu biết tính toán mới giàu, ăn tiền của người giàu không phải dễ, đây là chân lý khong bao giờ thay đổi, tuy nhiên khi nhà giàu xuất hiện thì không ít chị em phụ nữ ngưỡng mộ, biết là ăn không được nhưng vẫn nuôi hy vọng

Tui thấy mấy em chân dài khoái người giàu nhưng suy cho cùng, người giàu biết tính toán mới giàu, ăn tiền của người giàu không phải dễ, đây là chân lý khong bao giờ thay đổi, tuy nhiên khi nhà giàu xuất hiện thì không ít chị em phụ nữ ngưỡng mộ, biết là ăn không được nhưng vẫn nuôi hy vọng

rua2m

Re: ăn bạo

Re: ăn bạo

Ít ra nhà giàu cũng có chút ít để ăn

Chớ nghèo thì cạp đất mà ăn

Em Ngọc Trinh của bác Sim nói

Chớ nghèo thì cạp đất mà ăn

Em Ngọc Trinh của bác Sim nói

_________________

8DonCo

Page 2 of 2 •  1, 2

1, 2

Page 2 of 2

Permissions in this forum:

You cannot reply to topics in this forum

Home

Home